- section 1

- faking gnp

resources

private growth and government growth

- section 2

- raising GDP does not necessarily improve your life

talking nonsense about ‘growth’

correcting government interference

government austerity is a stimulant to national economies - shame it hasn’t been tried yet

increasing unemployment does not predictably destroy gdp

- section 3

- just some of the flaws with gdp

- section four

- how is gdp calculated?

government/tax elements on gdp

imputations

gdp and gdp-per-capita

transfer payments

price and value

- review and bibliography

related material

section 1 section 1

faking gnp

Taking a bucket of water out of one end of a swimming pool and pouring it into the other end is the equivalent to including government spending in the GNP.

This is the way government interference in the economy works. Money is taken from those that earn it and, instead of being spent on increasing productivity and building the businesses that produce the services, it is then spent on the latest fantasy or obsession of a politician. This is typical of five-year plans beloved of socialist parties and politicians who believe they know what’s good for you better than you do yourself.

For example, governments control schools as if most parents would not seek to arrange education for their own children. The money is taken from the earnings of the parents, going on 50% now in most modern states, and the supposed service (that is, the schools) become captured by politicians and unions, who then shape the system to suit their own advantages, rather than those of parents and children.

resources

Resources primarily consist of work, capital and time.

What you use the resources on is entirely a matter of choice. You may use them for bombs and bombing, for growing food and manufacturing flat-screen televisions, or for wasting on make-work. Meanwhile, at all times, there is a plentiful supply of predators seeking to capture resources without the annoyance of producing them.

private growth and government growth

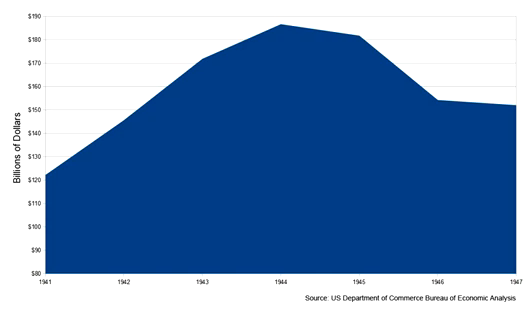

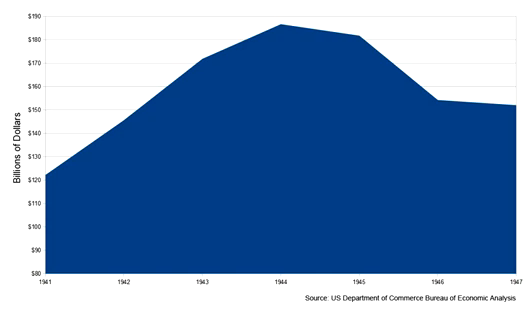

USA GDP between 1941-1947

Notice that GDP fell rapidly at the end of the World War [1945]. Now what was this GDP during the war? A great deal was making war materials such as bombs and aircraft. These then went on to be exploded, while many of the machines of war were shot out of the sky or otherwise blown up.

At the end of the war, large numbers of soldiers were demobbed and, of course, vast numbers of the people making the bombs and war materiel lost their jobs.

And as you can see, the overall GDP dropped.

Now the pseudo-Keynesians forecasted a slump. Now going onto the next graph:

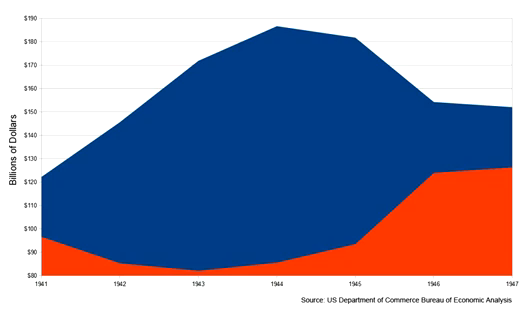

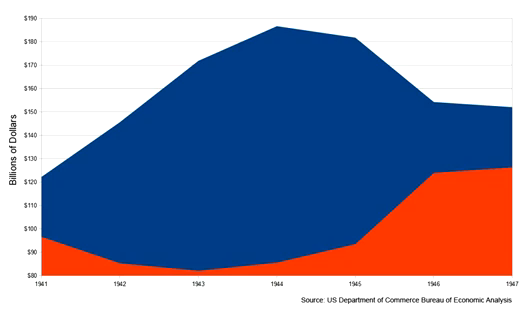

USA government [in blue] and private sector[in red] GDP between 1941-1947

Now this is the same graph, with the GDP split into government and private sector production. Here, the blue area represents government production, whereas the red area represents private sector production.

So now you can see that, although the GDP dropped, private sector production leapt ahead. Instead of making bombs and tanks, industry turned its hand to making refrigerators, houses and amazing chrome-covered cars, still to be seen in old films, museums and at vintage rallies.

Now under which circumstance do you imagine that the standard of the living of the population was greater or less?

section 2 section 2

raising GDP does not necessarily improve your life

hidden and delayed taxation

President Obama and the IMF are playing the same disinformation game.

This is fairly complex, because government steal/tax citizens both through inflation (quantitative easing in the latest euphemism) and by so-called government borrowing.

These two hidden/delayed taxes, in fact, work in tandem. See The mechanics

of inflation: the great government swindle and how it

works if you wish to understand the inflation end of this in more detail.

Obama is trying to buy votes with hidden/delayed taxation. That is a major part of the terrifying debt threatening the USA. The same problem that most European governments are struggling to control has been caused by similar socialist governments.

how to raise gdp

The UK economy is, supposedly, £1.8 trillion a year (the GDP).

The Socialists gain control of the government

Say they borrow an extra £180 billion a year (this is the deficit).

They ‘employ’ a million unproductive diversity advisors at £180,000 p.a. each.

The GDP rises by 10% as the economy steadily deteriorates.

The Conservatives take over

Say they sack one-sixth of the diversity advisors, thus saving £30 billion - a year!

Of course, such people now go on the dole, or have to do some productive work.

(Transfer/dole payments are not included in the GDP. If they get a real job, then GDP will rise.)

GDP falls by one-sixth of ten percent, about 1.66%.

Ed Balls [Shadow economics minister], Ed Miliband [leader of the socialist Opposition] and their political colleagues screech about a ‘double dip recession’ and all manner of similar nonsense. They also go on about lost ‘employment’.

The reality is the economy gets better, and produces more.

So the Left (socialists) squeal.

Eventually, less money is taken in tax from productive industry,

and tax take increases if ex-diversity advisors take up real jobs instead of government make-work.

(Remember government ‘employees’ do not, in fact, pay tax as all their ‘wages’ come out of taxation.)

Of course, the diversity union loses subscriptions from their lost members, and the ‘New’ Labour Party lose the part of that money which is returned by the unions to the party.

So it’ s win win win for everybody but the unions and union-supported parties. Certainly, the national standard of living rises, and there is less government interference from innumerate dogmatists.

You might wonder how Barak Obama manages to borrow an extra 10% of the United States GDP each year, and also manages to boast of a 2% rise in GDP this year.

Be aware that quantitative easing - money printing in ordinary English - and government ‘borrowing’ are, in fact, tax rises.

talking nonsense about ‘growth’

The notion of eternal ‘growth’ is rank irrationality. The real world is subject to reality limitations. These limitations apply however large or distant the resources may be. They are not affected by the nonsense developed by dishonest socialist government money manipulation.

If you borrow £1,000 or £100,000 for a house, or a few trillion if you’re trying to buy votes à la Obama and Gordon Brown, you can have a fine party on the loans.

Then comes the hangover as you try to pay back those loans.

Paying back the loans means a lower standard of living than you could enjoy previously, before you took out the loan.

The UK is now working to pay down loans; starting by borrowing less each year. And beyond that, the government is repaying down Brown’s profligacy.

Of course, standards of living will recede during that process.

Only a crazy person, or a Socialist, would be babbling about ‘growth’ in this mess.

correcting government interference

Context, July 2012: newly released UK quarterly GDP figures appear to be poor.

Britain’s economic problems are being sorted out.

The UK’s biggest problem is the ridiculous debts run up by the previous socialist government.

It is not sane to try to correct the chaos of socialist economics overnight. You cannot suddenly take government support for the poor without causing further distress amongst people who are not used to supporting themselves, and those of limited education.

Government costs are being sliced from every direction, which allows the tax producing part of the economy to start on the long road to recovery.

There is no election for 3 years. Let the socialists bleat. They are entirely irrelevant.

GDP figures are next to meaningless. Meanwhile, there are about 90 days in a quarter, and two-sevenths of them are weekends. That is, there are approximately 64 working days. One day extra holiday is therefore approximately 1.33%.

The highly dubious provisional GDP has gone down by around half that.

You really must panic right now, Eds Balls and Miliband say so.

"As for "austerity," though the word conjures up slow growth in the minds of many, economic history reveals spending restraint as a stimulant. Indeed, the problem today in a recessed Europe isn't governmental austerity, but the unsung reality that the latter hasn't yet been tried."

increasing unemployment does not predictably destroy gdp

From

Growing Public: Volume 2, Further Evidence: Social Spending and Economic Growth since the Eighteenth Century by Peter H. Lindert (Apr 19, 2004) p.120

“The negative impact of unemployment compensation on jobs is consistent with its lack of impact on GDP. The reconciliation involves the fact that making unemployment compensation more generous removes lower-productivity labour, raising the average productivity of those who continue to work. By itself, this offsetting productivity response probably does not push the overall effect on GDP to zero. Rather, it probably pushes it close enough to zero to be offset or even reversed by any growth-enhancing force correlated with provision of safety nets for the unemployed. One possibly positive correlate is even suggested by the tests shown here. Spending on active labour market policies may even have sufficiently positive effects on productivity to raise GDP despite their holding more people temporarily in the unemployment bin.”

This is fully in accord with my own experience. The removal of one nuisance from the workplace inevitably resulted in equal or greater sum productivity

Note: it is well-known that increasing unemployment raises (not lowers) productivity, because the least productive are selectively removed from the work place.

section 3 section 3

just some of the flaws with gdp

This section can be seen as a clarification and development of well-known issues that are put clumsily in the part of the book reviewed below.

The notion of the ‘economy’ is a wild generalisation. In the real world, there are just individuals swapping pen-knives for comics in the playgrounds of the world. The notion of the ‘economy’ is a wild generalisation. In the real world, there are just individuals swapping pen-knives for comics in the playgrounds of the world.

[...] many of the services people used to received from other family members and close acquaintances in the past are now purchased on the market. This shift translates into a rise in income as measured in the national accounts [...] gives a false impression of a change in living standards, it merely reflects a shift in non-market to market provision of services.

Invariably, money taken by governments in the form of taxes will incorporate a large element and corruption, while political actors, inevitably, will be extracting rents for their pockets. Thus, to count government expenditure as if it adds as much value to an economy as the money you spend on a flat-screen television (including tax!) is an unpleasant joke. Invariably, money taken by governments in the form of taxes will incorporate a large element and corruption, while political actors, inevitably, will be extracting rents for their pockets. Thus, to count government expenditure as if it adds as much value to an economy as the money you spend on a flat-screen television (including tax!) is an unpleasant joke.

Production can expand while income decreases, when you take into account the sum of depreciation in a society. This become worse in that monetised repairs will be added to GDP! Thus the more that breaks down and is repaired, the higher the GDP will go. Of course, this is hardly an increase in living standards. Production can expand while income decreases, when you take into account the sum of depreciation in a society. This become worse in that monetised repairs will be added to GDP! Thus the more that breaks down and is repaired, the higher the GDP will go. Of course, this is hardly an increase in living standards.

Consider particularly, the planned obsolescence that many corporations build into their products.

Capital and income Capital and income

If you own your house free of mortgage, your income will be far more satisfactory than if you rent, or if you have a heavy mortgage to service. Remember that GDP pretends to measure your standard of living., but you can see that the same income may give different living standards.

A major form of capital in modern society is the amount of useful information you have crammed into your head, very crudely termed ‘education’. A major form of capital in modern society is the amount of useful information you have crammed into your head, very crudely termed ‘education’.

Your standard of living is intimately linked to your wishes and desires. If you are a workaholic, and your job is your life, and you have chosen that life, your standard of living is far higher than if your approach to life is “I hate Mondays”. If, alternatively, you live on the dole and are content to live frugally, go down the park for a couple of hours and then go watch the boob-tube, then your freedom and contentment will be greater than that of some civil service clerk yearning to be discovered as a hidden genius. Your standard of living is intimately linked to your wishes and desires. If you are a workaholic, and your job is your life, and you have chosen that life, your standard of living is far higher than if your approach to life is “I hate Mondays”. If, alternatively, you live on the dole and are content to live frugally, go down the park for a couple of hours and then go watch the boob-tube, then your freedom and contentment will be greater than that of some civil service clerk yearning to be discovered as a hidden genius.

Thus you may be happy with your Ferrari and long office hours, or you may be happy throwing a stick for a dog while sitting on a park bench with a six pack, becoming slowly addled.

So your standard of living is not necessarily measured in money and GDP, it may also be measured in leisure, freedom of choice, your relationship with your yak, or your ability to dream your life away.

section 4 section 4

how is gdp calculated?

The worker works for the factory.

The factory makes sweeties.

The factory owners pay the worker.

The worker may pay help to keep his home clean and tidy while he slaves at the factory.

The help may fancy some sweeties after a heavy day’s tidying, and so goes to the shop to buy some.

The shopkeeper will then buy more sweeties from the factory.

At each stage and under many excuses and guises, the government will snatch some of the money, usually called taxation.

The amount that the factory pays the worker will be taxed. What remains after the tax the government-instructed statisticians will call his ‘net’ income. Never mind that, if the worker goes to the shop to buy some sweeties, the shopkeeper, acting for the tax collector, will charge the worker V.A.T. (value added tax).

The price of the sweeties also has to include the cost to the shopkeeper of the various taxes he has to pay, such as property tax, tax on profits and even the tax the shopkeeper has to pay on any income that the shop pays him. And we still haven’t spoken of extra taxes such as a licence to pay for the government’s television station, super tax on the fuel for his delivery van, and so on.

The net income of all the workers will be added together to form a major part of the GDP figure. Notice that this will mean that the net income of the worker, and the net income of the help that has to come out of the wages of the worker, will both be added into the GDP.

Looking at the illustration above, you can see that the money in an economy goes around in very complex circles - there are thousands of shops and factories and millions of

workers. Also notice carefully that an economy involves many actions taking place in time and in space. That is, the economy is highly dynamic and much more complex than the illustration above.

Of all this money that the government

is raking in, much will be paid out in wages and for objects such as computers and hospital beds. This money will also be added to the GDP. The government will also pay out a lot of money in doles and pensions etc. These are called transfer payments, and they will not be added into the GDP.

government/tax elements on gdp

From 1961-2 to 2008-9, the cost per child in US government schools rose from $2,808 to $10,441 in constant dollars.

Meanwhile, the USA has dropped down international tables

for basic subjects like maths, science and English. The evidence is that throwing government/tax money does not

improve education standards.

[Source: nces.ed.gov]

“The average reading score for 17-year-olds was higher in 2008 than in

2004 but was not significantly different from the score in 1971.

— In contrast, the [maths] average score for 17-year-olds in 2008 was

not significantly different from the scores in 2004 and 1973.— At 12th grade [18yos], there were no measurable changes in [science]

average scores for any racial/ethnic group when comparing results from

2005 with those from 1996.” [Quoted from nces.ed.gov]

Government contribution to matters like health and education is

measured in terms of inputs. Naturally, any sane measure is

in terms of outputs, not inputs. Thus, there is no reasonable comparison between private expenditure

and public expenditure/waste,

but both are treated as if they are in GDP calculations.

So, the more government taxes, and spends/wastes, the higher

goes the GDP. This gives a very false indication of improvement

in economies when very little advance is made in the real world. It

is common for socialist governments to raise expenditures and

then claim a rising GDP. And these extra taxes are taken from productive industry.

Thus, GDP increases with no discernable improvement in school

or hospital results (meanwhile, medicine is advancing in terms of

capability - see note immediately below). Gradually, governments are seeking stats on outputs. Using output measures, medical services in the USA score well ahead of those in Europe.

[Note:

Of course, most new drugs and medical equipment originates in the

USA. These are then copied in Europe, and eventually throughout the

world.]

imputations

GDP measures are such a mess that it is difficult to work out what governments want from it, or even whether governments themselves have clear objectives. Do governments want these figures for some objective of codifying more things to tax; or is it an attempt to fool people into believing that their living standards are rising when they are not; or is it perhaps a way of convincing citizens and other countries that your particular country is doing rather well?

To add to the confusions comes the idea of imputation. Figures are added to the GDP, though the reasoning for this is a bit obscure. An amount is added to GDP that amounts to the rent people pay for their accommodation. So in a dubious attempt at supposedly providing ‘better’ data, a figure is imputed for those households that do not rent, but who ‘own’ their own house. This figure is equivalent to the rent the householders would be paying if only they were paying rent. And this imputed number is also added to the GDP.

The USA has a considerably higher standard of living than most other advanced Western societies. For example, the average person labelled as ‘poor’ (see note immediately below) in the USA has good quality housing about twice the size of middle income families in Europe or Japan. Everything is also cheaper in the USA because the US government takes less in tax.

Therefore, there are now foolish suggestions that European countries should impute higher incomes (and, therefore, GDP) by adding in notional values for the rather inferior government ‘services’, such as government medical systems in Europe. Remember that this has already been added once to the GDP under the heading of government spending and, thus, would be double counting.

[Note:

This is the highly dubious notion of relative poverty, beloved of quasi-government agencies.]

As if that were not enough, discussions are also extending the idea that governments might also impute still more GDP by adding in a value for leisure time, and even for environmental standards. Whether the objective is a hope that government might extend its intrusions still further by trying to tax leisure, or perhaps to pretend that French living standards (see note immediately below) are nearer to American standards (Americans do work harder/longer on average), is unclear.

[Note:

No, this isn’t a joke,

the quoted book really is promoting this! For instance, see page 55.]

gdp and gdp-per-capita

Strangely, sometimes people confuse GDP and GDP-per-capita. The Chinese GDP (fiddled as it is) is approaching that of the USA, whereas the Chinese GDP-per-capita is about a quarter or a fifth of USA levels. Of course, this is because China has a much greater population.

If the population is increased by immigration or birth rate, the greater the GDP will become - assuming that the GDP-per-capita does not change. Similarly, but reversed, with falls in population.

Then there is Russia, geographically the largest country in the world, with vast natural resources but a GDP only slightly bigger than that of the UK. However, the Russian population is almost twice that of the UK. Thus, the average Russian has about half the income enjoyed by the British. This is quite apart from the fact from the fact that Russia is riddled with corruption and has a monumental problem with alcoholism, which heavily undermines life expectancy, productivity and general health.

It is important not to treat GDP comparison figures at face value.

transfer payments

Remember, government GDP statistics ignore transfer payments.

Transfer payments are those payments taken from producers and given to the likes of pensioners and other doleys [benefit recipients - the unemployed who receive the dole].

Gordon Brown the Clown, like the Sheriff of Nottingham, took tax money in lieu of taking chickens and corn. He then gave the money to his comrades in the unions and to the doleys in the high hopes and expectation that they will repay Brown the Clown and his criminal mafia with votes.

Conservatives, on the other hand, are more likely to give the stolen corn and chickens to pensioners, because pensioners are more likely to vote for right-wing parties.

Modern governments take forty or more percent of production in taxation. At least half of this goes in transfer payments.

To remove these transfer payments from GDP gives a very false impression. Consider (as a cartoon) if you work in a car factory and produce 100 cars per week. The government takes 20 plus % of your cars, or chickens, or corn, and gives them to other people. These goods have been produced. The only problem is, you don’t get paid for them, and you don’t have them.

As for the other 20% or more of your production

the government takes, and is accounted for, you can think of those cars as being sold off by the government in order to pay for politicians pensions, the military, roads, diversity awareness officers and other such good causes.

price and value

As for artists and value, Vincent Van Gogh didn’t sell a single painting in his lifetime. Now a single canvas has fetched over $50,000,000.

advertisement

review and bibliography

It is surprising how little you can find about GDP in books on economics that is of any real use. You will find some rather crude definitions and a bit of airy-fairy hand waving. You can delve deeply into government statistics to find the calculations in any country.

But, you can find very little on just how crude, useless and misleading are measures of GDP. This page is designed to take apart the Gimcrack ‘logic’ is in relation to the real world.

The notion of the ‘economy’ is a wild generalisation. In the real world, there are just individuals swapping pen-knives for comics in the playgrounds of the world.

This book is, again, very crude, but it is one of the very few books where an attempt is made to summarise GDP. In this book, the main section of use is pages 23 to 59. Even this section is remarkably clumsy and crude. In fact, the best part of the book is the foreword by Nicholas Sarkozy, who commissioned the work.

Mismeasuring our lives: why GDP doesn't add up

by Joseph E. Stiglitz et al., with foreword by Nicholas Sarkozy |

|

The New Press

ISBN-10: 1595585192

ISBN-13: 978-1595585196

$10.85, 2010 [amazon.com] {advert}

£10.79, 2011 [amazon.co.uk] {advert} |

Kindle edition

719 KB

The New Press 2011

ASIN: B005NIFFJA

$9.92 [amazon.com] {advert} |

A different, free version of this report is now available as a

.pdf download (3,235 kb). |

related material

citizen’s

wage

GDP 2: GDP

and other quality of life measurements |