|

|

|

|

|

|

||

|

|

|

|

|

|

||||||||||||||||||

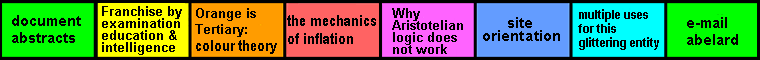

| EMU (European Monetary Union) and inflation – a civil liberty issue is one of a series of documents about economics and money at abelard.org. | ||

| moneybookers information | e-gold information | fiat money and inflation |

| advertising disclaimer |

|||

| Introduction | |||

| Analysis in seven sections | |||

§ |

section 1: politics without brains

or ethics section 2: recent currency debauchery in the uk section 3: governments love inflation section 4: innumerate workers section 5: wealth transfer via emu section 6: big business section 7: political venality |

||

| Reference section | |||

| 1 2 3 4 5 6 |

Political and technical considerations Private money Future developments Backup material Understanding inflation What is to be done |

||

introduction 1998 My major concerns are

Both issues have considerable civil liberty implications. Being a complex matter, I have divided this summary into sections, with

a reference section in the second part which includes several web site

sources. |

|||

section 4: innumerate workersSome economists, for instance James Tobin of Yale University (1972), say that a small amount of inflation, say 2.5 to 3 percent, allows greater job market flexibility. Essentially this is because Joe Six-pack doesn’t realise his wage packet is decreasing if the numbers stay the same. Such slow inflation then, has the potential to ease downward wage flexibility where particular skills are becoming less marketable. Without flexibility, it is argued that there would be more worker unrest and more unemployment. This view, concerning helpful levels of inflation, I accept as an interim measure until populations are better educated. Another element of inflation is that it is used in order to let countries and companies off the results of failed investment or borrowing decisions. This is done by using inflation as a tax on the mass of workers and savers. It could be argued that this avoids depressions such as those that have hit world markets at regular 50-60 year intervals under a more rigid ‘morality’ (see also the paper by Greenspan and Parks.) It is possible to argue that this process is ‘a good thing’, but I have yet to see it thus argued, even though it is widely practised. As an elitist, it is possible to suggest that removing resources from the mass in order to enable their masters to continue to function, thus providing jobs and continuity, is a necessary process. I would prefer to remove such dishonesty and manipulation from the system

by concerted education. |

reference section1 First, some political and technical considerationsSee the chapter by Congdon (pp76-90) in The Euro Congdon just does not think the Euro will work technically. He lays out the technical reasons for this, reasons with which by and large I agree, though he could be over-egging the pudding. His sentence structure can be a little convoluted. I have a great deal of regard for Congdon’s economic understanding (I have not much regard for the stuff put out by most who describe themselves as ‘economists’ J ). This book also has four useful appendices giving the extracts from the

legal documents that purport to define the Euro (pp. 269-290). Further to this, John Redwood’s

book, Both these references above have an air of being rushed out, but that is of course the nature of the situation as venal politicians and bureaucrats try to bounce Europe into this ill-starred project. For other semi-technical reasons and a better summary of some of the libertarian issues, a short article by Milton Friedman (The Times, 19 November 1997, p.22) is well worth a look. again, there is some inconsistency in his position. David Owen has recently written a

thoughtful and temperate, if rather diplomatic, article, I think it worth reading for those concerned with this issue. The extended net version is more useful than the cut-down print version. However, I point out a considerable error in the section, The need

for convergence, The Bundesbank was over-ruled when it opposed the inflationary conversion

of ostmarks to There is also a minor glitch in the section, The British opt out, paragraph 6, where Owen states that a decision to join is “effectively.... irrevocable”. That is an exaggeration, but he is correct that such action could have (and most likely would have - abelard) “appalling consequences”. However, it would be my strong expectation that such detachments from the Euro will eventually occur, however dire the consequences, should any be foolish enuf to join the circus. Joining the Euro will inevitably see very large rises in UK direct and indirect taxation through inflation, for it is growing ever more clear that the Euro is likely to be a soft currency. Thus we will end up both settling the huge national debts of countries like Belgium and Italy, and funding the enormous continental government pension commitments, if these countries continue to fail to re-order their present arrangements. For example, see the over-optimistic article Given such a scenario, we will import other countries' structural unemployment

rates, which rates will continue to climb. My concerns, as stated, are not primarily technical. as you will note,

I am not always entirely convinced by Friedman, Congdon and Redwood. the

section above is supplied as a resource for those wishing to inform themselves

on these technical matters and political considerations. |

2 private moneyMonographs published by the IEA: With less currency options, there is less ability to avoid a government

cheating citizens by using inflation. Regarding James Tobin of Yale University (1972),

see short review in See also The mechanics of inflation. |

3 future developmentsFor some implications of future developments, see Catherine England on

the Cato site at |

4 back-up material1) A recent report stated that over 250 local exchange systems had appeared

in France recently, as mainly unemployed individuals struggle to get government

off their backs. Such is the real wave of the future however much governments

may pursue their grand schemes. (The European 2-8th February

1998, p.32) |

5 understanding inflation and why it is so very undesirableFor a more full development of the inflation issue and the multiple problems

it generates, see the Costs of Inflation and Disinflation at This is an excellent review. I cannot recommend it too highly. (There is one minor issue which I wish to check out- self note!) For a less technical and more pedagogic approach,

see the excellent speech by Greenspan with useful commentary by Lawrence

Parks, available on the FAME site: |

6 so, what is to be done?Both inflation and deflation are forms of dishonest money. They both result in un-negotiated transfers of wealth. The idea of ‘stimulating the economy’ by ‘deficit’

is undesirable, as far as I am concerned. See the very useful review of ‘Keynsianism’ at http://www.digiweb.com/igeldard/LA/economic/keynes.txt [currently unavailable] I want to see radical changes in the cultural relationship to ‘money’. At present, the debauchery of ‘money’ via deficit spending is a dangerous moral corrosive. I regard this as far more important than the present blasé, and widely unconscious, approach to fiat money. In my view, understanding of the widespread and damaging ramifications of inflation is very poor, even among ‘economists’ and ‘politicians’. To quote Keynes loosely, not one person in a million is able to diagnose the manner in which inflation operates: not much changes. Keynes also claims that Lenin recommended inflation as a sure manner in which to destroy a state. A fundamental means to such radical changes must be to teach the nature of fiat money and the effective handling of money from very early in the educational process. I want inflation indices that incorporate wage levels, housing prices

and stock exchange levels. It is important that the myth that the RPI

is greatly related to inflation be debunked. ‘Stimulating the economy’ is often done by using infra-structure projects of the type widely practised by governments and funded by deficit spending. These projects may be useful government initiatives in times of difficulty, but they may not involve clear GDP increases. They may not have, therefore, a simple relationship with monetary stability. It is the test of such links that I would consider germane. Such projects are political issues and inflation is a rather poor and

destructive way of funding them. Money is essentially a communication media. To debauch money is to encourage lies and dis-honesty. That is counter to clear education and social progress. It is counter to good and improving government and society. A reason for the housing boom, and the still very high prices, is the tendency for housing to be seen and used as a hedge against government inflation in countries with amoral politicians. Inflation drives such false markets, causes confusion and disrupts trade. In time, reduced taxation relative to GDP may be important, but I wish to see greater expenditure, as a percentage of GDP, on education and with no reduction of defence expenditure. USA. (self note) dated from 10/2/98 Comments are invited..... |

End notes |

© abelard, 1998 (10 February, slightly updated and

edited on 3 June, 1998) the address for this document is https://www.abelard.org/emu/emu-hi.htm 3671 words |